Are you looking to tap into the wealth hidden in your home? A Home Equity Line of Credit (HELOC) might just be the solution. With this flexible financing option, you can access funds for anything from home renovations to unexpected expenses. But before diving in, it’s essential to understand how much you’ll actually pay back each month. This is where a payment calculator for your home equity line comes into play.

A payment calculator helps you estimate your monthly payments based on various factors like interest rates and borrowing amounts. It’s an invaluable tool that gives clarity amidst the complexities of borrowing against your home’s equity. So, let’s dig deeper into what a HELOC is all about and how using a payment calculator can simplify your financial planning!

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit, commonly known as a HELOC, is a revolving credit option that allows homeowners to borrow against the equity in their property. Essentially, it transforms the value of your home into accessible cash.

With a HELOC, you can withdraw funds up to a certain limit during a specified draw period. This flexibility makes it an attractive choice for many homeowners looking to finance various projects or pay off high-interest debt.

Interest rates on HELOCs are often variable and may fluctuate over time. It’s important to keep this in mind when planning your budget.

Payments typically begin once you start drawing from the line of credit, usually consisting of interest only during the initial phase. Afterward, borrowers must repay both principal and interest within the set repayment term.

How Does a HELOC Payment Calculator Work?

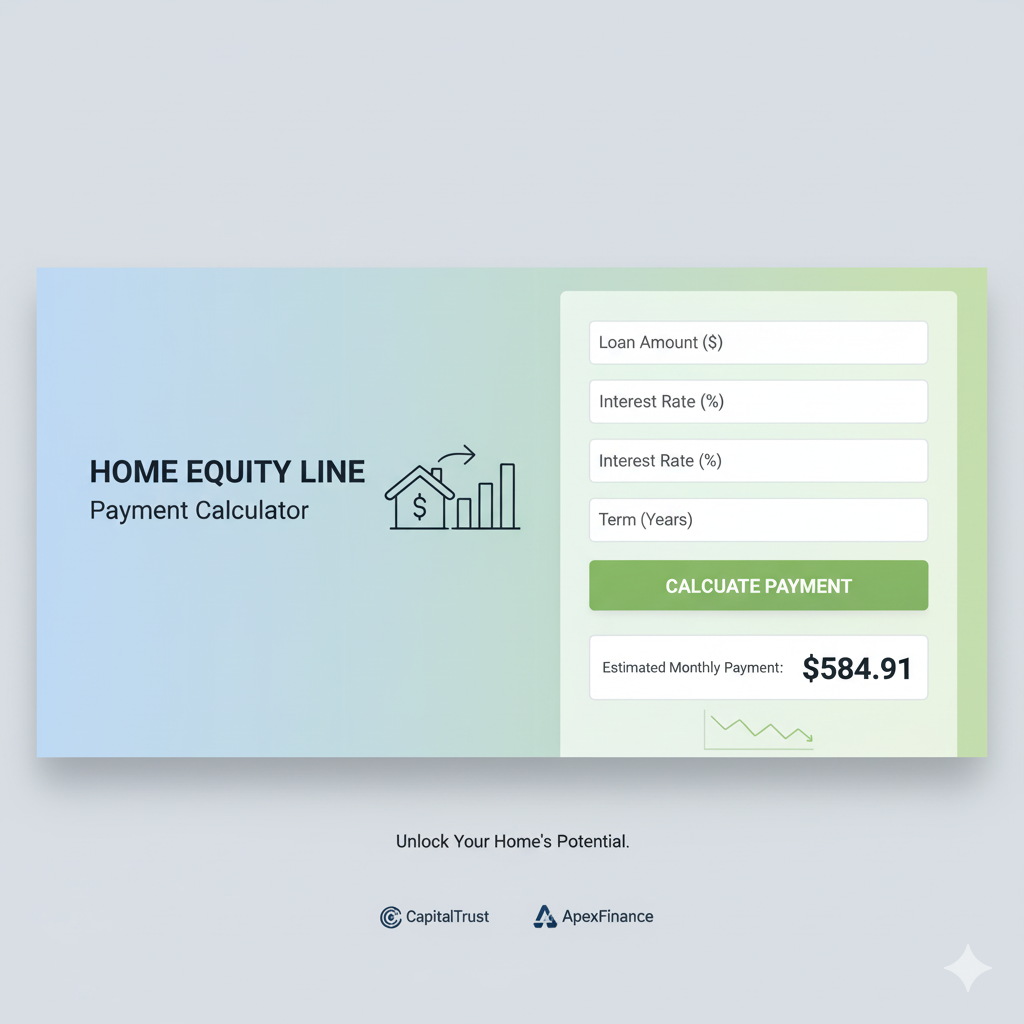

A HELOC payment calculator is a straightforward tool designed to help you estimate your monthly payments on a home equity line of credit. By inputting key figures, like the loan amount, interest rate, and repayment period, it generates an approximate monthly payment.

The calculator typically incorporates both the principal and interest components. This allows homeowners to visualize their financial obligations more clearly over time. Some calculators even provide options for varying interest rates or different draw periods.

You can also see how changes in these variables impact your payments. For instance, adjusting the loan amount helps illustrate potential scenarios based on market fluctuations or personal finances.

With just a few clicks, you gain insights that empower informed decisions about borrowing against your home’s equity. It simplifies what can often be a complex financial process into easily digestible information.

Factors to Consider When Using a HELOC Payment Calculator

When using a HELOC payment calculator, several factors come into play. First, consider your credit score. A higher score often leads to better interest rates.

Next, think about the amount you want to borrow. This will directly influence your monthly payments and total interest costs over time.

Don’t forget the draw period versus repayment period. The terms of these periods can significantly affect how much you pay each month.

Also, keep an eye on variable interest rates associated with many HELOCs. Fluctuations in rate might change your calculations later on.

Factor in any additional fees or closing costs related to the line of credit. These can add up quickly and alter your overall financial picture when budgeting for repayments.

Benefits of Using a HELOC Payment Calculator

Using a HELOC payment calculator can simplify your financial planning. It gives you a clear picture of potential monthly payments, helping you budget effectively.

With this tool, you’ll quickly see how different interest rates and repayment terms impact your costs. This flexibility allows for informed decisions tailored to your financial situation.

Another advantage is the ability to compare multiple scenarios side by side. You can assess various borrowing amounts and durations without any guesswork involved.

Additionally, many calculators offer insights into total interest paid over time. Understanding these long-term impacts helps in evaluating whether tapping into home equity fits within your overall financial strategy.

Using a payment calculator saves time. Instead of manually calculating figures or relying on estimates from lenders, you have immediate access to accurate numbers at your fingertips.

Tips for Using a HELOC Payment Calculator Effectively

To get the most from a HELOC payment calculator, start by inputting accurate data. Include your current home value and any existing mortgage balance. This precision helps in estimating your available equity.

Next, be mindful of variable interest rates. Since HELOCs often come with adjustable rates, consider future rate increases when calculating payments.

Don’t forget to factor in loan terms and repayment options. Whether you choose interest-only payments or principal plus interest will significantly affect your monthly obligations.

Regularly update your calculations as market conditions change or personal circumstances shift. Staying proactive ensures you’re not caught off guard by fluctuating costs.

Compare multiple calculators online before deciding on one that fits your needs best. Different tools may offer unique features that enhance usability and accuracy for your specific situation.

Alternatives to Using a HELOC Payment Calculator

If a HELOC payment calculator isn’t quite what you need, there are several alternatives to consider. One option is to consult with your bank or lender directly. They can provide tailored estimates based on your financial situation.

You might also explore budgeting apps designed for home financing. These tools often include features to help track expenses and forecast future payments without the complexity of a dedicated calculator.

Another alternative is engaging a financial advisor. They can offer personalized insights that go beyond simple calculations, helping you understand the long-term implications of using a HELOC.

Online forums and communities may be useful resources. You can find shared experiences from others who have navigated similar decisions, offering valuable perspectives that calculators alone cannot provide.

Conclusion

Understanding the nuances of a Home Equity Line of Credit (HELOC) can be complex, but utilizing a payment calculator effectively simplifies that process. By entering key information such as your credit limit, interest rates, and repayment terms into a HELOC payment calculator, you gain valuable insight into what to expect regarding your payments.

When using this tool, consider all relevant factors like fluctuating interest rates and potential fees. These elements can significantly impact your overall cost. It’s also worthwhile to explore tips for effective usage—like keeping track of changes in property value or understanding loan-to-value ratios—to better gauge how much equity you’re accessing.

If traditional calculators feel limiting or overwhelming at times, remember there are alternatives available. Online financial services often provide detailed breakdowns and personalized advice tailored to individual circumstances.

Navigating through home equity lines doesn’t have to be daunting when you take advantage of tools designed for ease and clarity. A well-informed approach will empower you on your financial journey with confidence and foresight.