When it comes to protecting your home, understanding the factors that contribute to your insurance cost can feel like a daunting task. Home insurance is not just a safety net; it’s an essential investment for homeowners. But how do you determine what you should actually expect to pay? The term “approximate home insurance cost” often pops up, but navigating through the specifics can seem overwhelming.

Don’t worry! Whether you’re a first-time buyer or looking to reassess your current policy, this guide will break down everything you need to know about home insurance costs. From various influencing factors and average pricing insights to tips for saving money on premiums, we’ve got you covered. Let’s dive in and arm ourselves with knowledge about ensuring our homes without breaking the bank!

Understanding Home Insurance

Home insurance is designed to protect your property and belongings from unexpected events. This type of coverage typically includes protection against natural disasters, theft, and certain types of damage.

Policies may vary widely in terms of what they cover. Basic plans usually offer dwelling coverage for the structure itself, personal property coverage for items inside your home, and liability protection in case someone gets injured on your property.

It’s important to read through policy details carefully. Understanding exclusions—situations not covered—is crucial to avoiding surprises when you need to file a claim.

Additionally, some policies offer additional living expenses if you’re temporarily displaced due to damage. Knowing this can provide peace of mind during stressful times.

Grasping the fundamentals of home insurance helps ensure that you’re making informed decisions about protecting one of your most significant investments.

Factors That Affect Home Insurance Cost

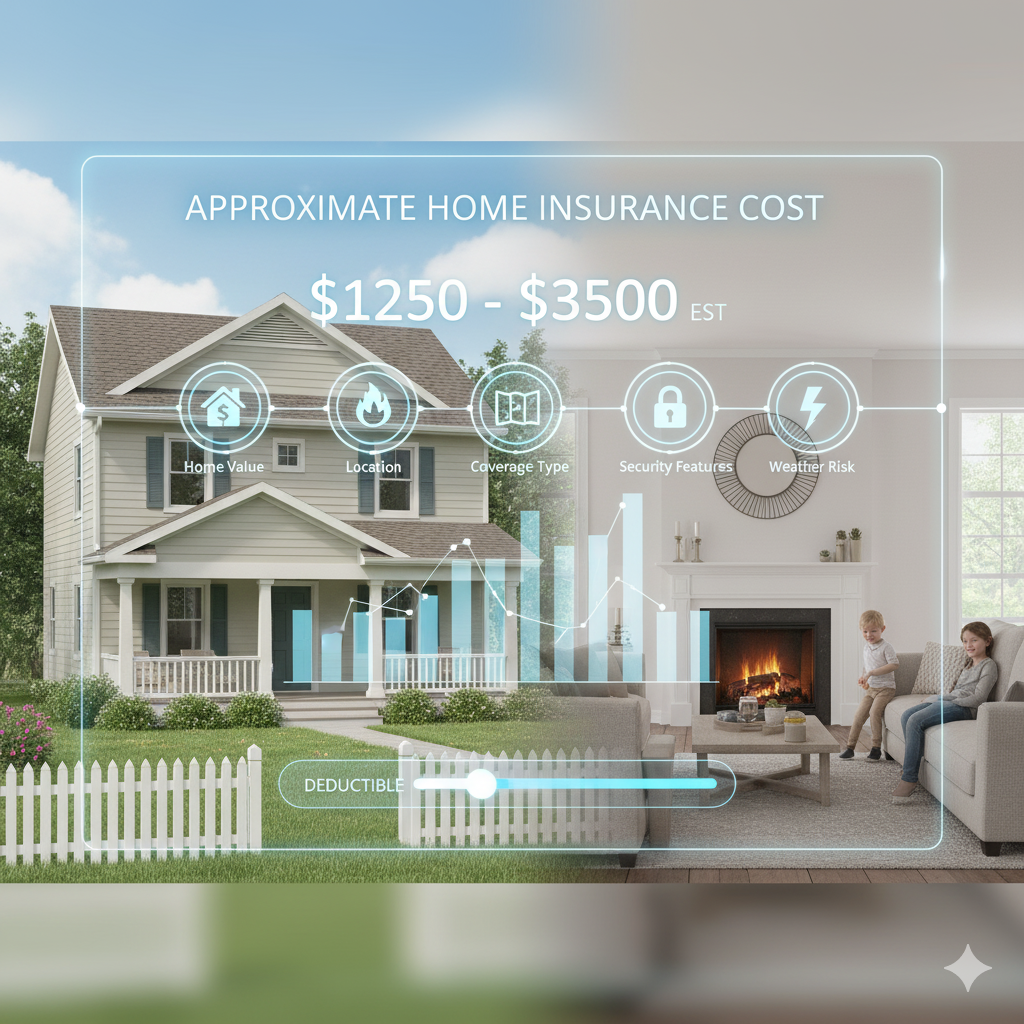

Several factors influence the approximate home insurance cost. Your home’s location plays a significant role. Areas prone to natural disasters, such as floods or earthquakes, often lead to higher premiums.

The age and condition of your home also matter. Older homes may have outdated wiring or plumbing that can increase risk for insurers. Regular maintenance can help keep costs down.

Another key factor is the value of your belongings. The more valuable items you own, the higher your coverage should be. This directly impacts your premium.

Credit scores can affect rates too. A better score often translates into lower insurance costs because it indicates responsible financial behavior.

Understanding these elements helps in estimating what you’ll pay for coverage while ensuring adequate protection for your property and possessions.

The Average Cost of Home Insurance

The average cost of home insurance varies significantly across the United States. On average, homeowners pay around $1,200 annually. However, this figure can fluctuate based on various factors specific to each homeowner’s situation.

Geographic location plays a crucial role in determining rates. Homes in areas prone to natural disasters or high crime rates often face higher premiums.

The type and value of your home also impact costs. A historic property might require more coverage than a newly built one due to its unique features.

Additionally, the amount of coverage you choose affects pricing as well. Opting for lower deductibles generally results in higher premiums.

Understanding these nuances is essential when budgeting for approximate home insurance costs. It allows homeowners to make informed decisions tailored to their needs and circumstances.

Tips for Reducing Home Insurance Costs

Reducing your home insurance costs can be easier than you think. Start by increasing your deductible. A higher deductible means lower premiums, but make sure you have enough savings to cover it in case of a claim.

Consider bundling policies. Many insurers offer discounts for combining home and auto insurance. This not only saves money but also simplifies managing multiple policies.

Look into safety features as well. Installing a security system or smoke detectors might qualify you for additional discounts. Insurance companies appreciate proactive measures that minimize risk.

Regularly review your coverage needs too. As time goes on, the value of your belongings may change, allowing adjustments that can lower your premium without sacrificing essential protection.

Shop around frequently. Rates vary significantly from one provider to another, so comparing quotes ensures you’re getting the best deal available at any given moment.

Comparing Quotes from Different Providers

When searching for the best approximate home insurance cost, comparing quotes is essential. Each provider has its own pricing structure and coverage options. This variance can lead to significant differences in premiums.

Start by gathering at least three to five quotes from different insurers. Use online tools or contact agents directly. Make sure you provide consistent information about your home’s details to ensure accurate comparisons.

Pay attention not just to the price but also what each policy covers. Some may offer lower costs but exclude critical protections that could be beneficial later on.

Don’t hesitate to ask questions about any unclear terms or conditions. Understanding what’s included can save you from surprises down the line.

Consider customer service ratings alongside premium costs. A cheaper quote might not be worth it if claims processing becomes a hassle later on.

Special Considerations for High-Risk Areas

Living in a high-risk area can significantly impact your home insurance cost. These locations often face more frequent natural disasters, such as floods, hurricanes, or wildfires. This increased risk translates to higher premiums.

Insurance companies assess various factors when determining rates. Proximity to coastlines or fire-prone forests might prompt insurers to charge extra for coverage.

Additionally, crime rates play a role. Areas with higher burglary or vandalism incidents may see elevated costs as well. Insurers look at the likelihood of filing claims and adjust accordingly.

Homeowners can mitigate some risks by investing in safety features like burglar alarms and reinforced roofs. These upgrades not only protect your property but may also lead to lower premiums.

Always discuss specific challenges related to your location with potential insurers. Understanding these details will help you make informed decisions about coverage options tailored for high-risk areas.

Conclusion: Finding the Right Coverage at the Best Price

Finding the right home insurance coverage at a price that fits your budget is an essential part of protecting your most valuable asset. Start by assessing your needs and understanding what type of coverage you require. Taking into account various factors such as location, property value, and specific risks can significantly influence the approximate home insurance cost.

It’s wise to gather quotes from multiple providers to ensure you’re not overpaying for similar coverage options. Don’t hesitate to ask about discounts or bundling options that could lower your premiums. If you live in a high-risk area, consider additional steps to mitigate risks, which may help reduce costs down the line.

Remember that finding affordable home insurance doesn’t mean compromising on quality or necessary protections. Take time to compare policies carefully and read reviews about customer service experiences with different companies. By being diligent in this process, you’ll be more likely to find comprehensive coverage tailored for you without breaking the bank. The key lies in balancing affordability with adequate protection so you can enjoy peace of mind while knowing your home is secure.